Rich Dad Poor Dad by Robert Kiyosaki is a personal finance classic that contrasts the money philosophies of two influential figures in the author’s life: his biological father (the “Poor Dad”) and his best friend’s father (the “Rich Dad”). The book highlights the key differences between how the rich and poor think about money, work, and wealth-building, with lessons designed to help readers achieve financial independence.

The Poor Dad, Kiyosaki’s real father, followed a traditional path of working hard, getting a good education, and saving for retirement. Despite having a stable government job, he struggled with financial stability. On the other hand, the Rich Dad focused on building wealth through investments, entrepreneurship, and financial literacy. He taught Kiyosaki that wealth is created by making money work for you, rather than trading time for money.

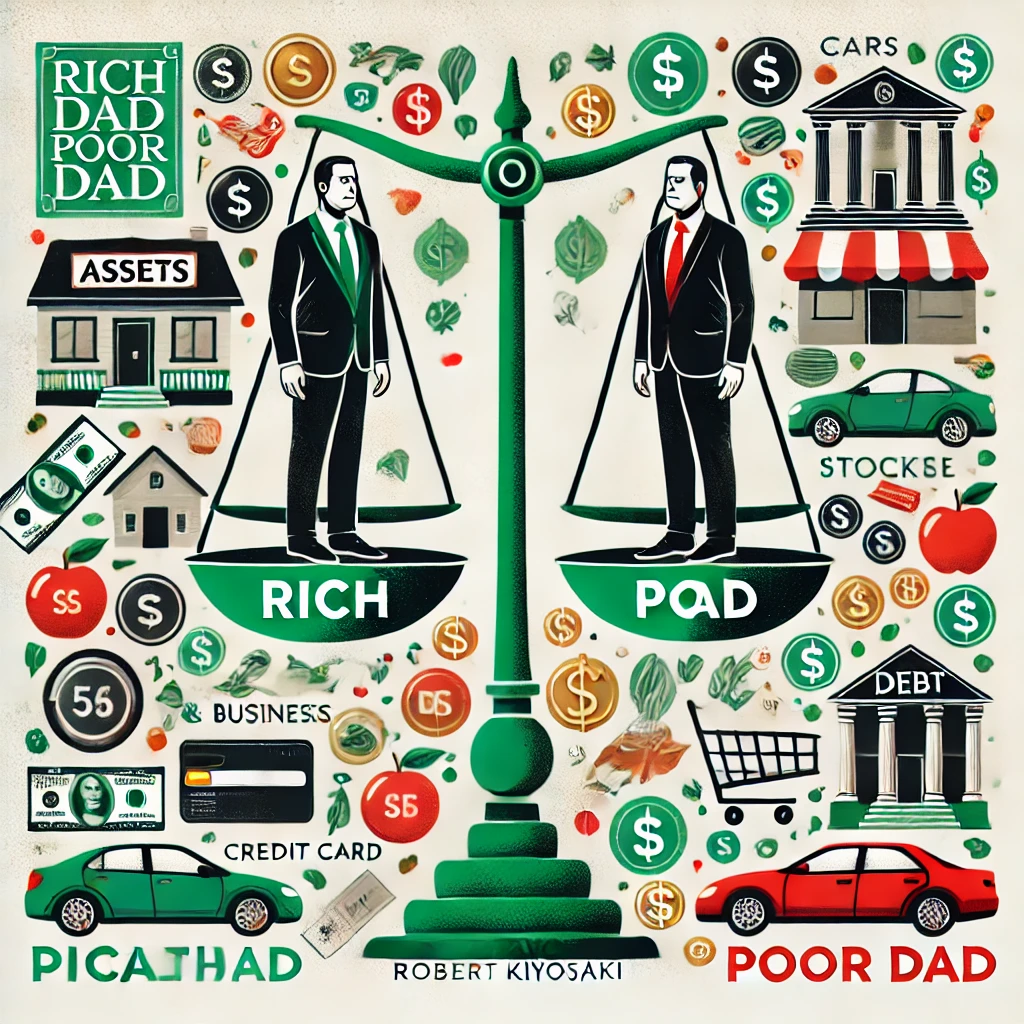

One of the key lessons of the book is the importance of assets and liabilities. Kiyosaki stresses that the wealthy focus on acquiring assets—things that put money into your pocket, such as real estate, stocks, or businesses—while the poor and middle class often accumulate liabilities, like cars and houses, which drain their financial resources.

Kiyosaki also emphasizes the importance of financial education. He believes that the traditional education system doesn’t teach people how to manage money effectively, leaving many to struggle with debt and financial insecurity. By understanding concepts like investing, entrepreneurship, and risk management, individuals can break free from the “rat race” and build wealth.

The book encourages readers to think differently about money and challenge conventional wisdom. Kiyosaki’s approach advocates for taking calculated risks, investing in assets that generate passive income, and continuously improving one’s financial literacy.

In summary, Rich Dad Poor Dad is a thought-provoking book that encourages readers to adopt a wealth-building mindset and prioritize financial independence. Its lessons about assets, liabilities, and financial education have made it a cornerstone of modern personal finance literature.